Commissioners Discuss Tax Increase for Fire Departments

By ANDY BEHLEN At a budget workshop meeting on Tuesday, Fayette County Judge Ed Janecka asked county commissioners for feedback from their communities about the proposed two-cent property tax increase to fund the county’s volunteer fire departments

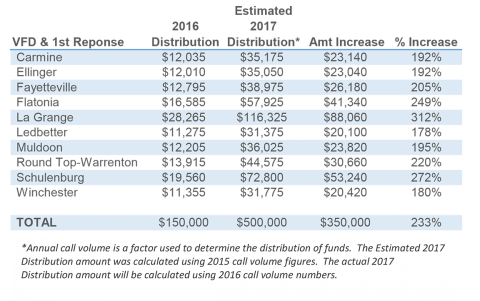

The proposed two-cent tax increase would bring in about $500,000 in additional revenue, which would be dedicated to the ten fire departments in the county. The county currently provides about $150,000 to the fire departments. Half of that money is distributed evenly ten ways. The other half is split according to a formula

“They’re saying two cents is not going to be enough,” Pct. 4 Commissioner Tom Muras said of his local fire department in Schulenburg.

“How are they making it now?” asked Pct. 1 Commissioner Jason McBroom. “I’m not against giving them more money, but we’re giving them a considerable jump.”

“On the other hand, the fire departments in my area said the two cents would just be awesome,” said Pct. 2 Commissioner Gary Weishuhn. His precinct includes the service areas of Ledbetter, Carmine, Round Top-Warrenton, Fayetteville and Ellinger volunteer fire departments. Those are among the smallest and least-funded VFDs in the county.

Muras said he received one negative comment from a Schulenburg citizen about the tax. The citizen said the tax increase would amount to double taxation for fire services since they already pay city taxes, which help to fund the fire department there.

“I can appreciate that, but how else can we do this?” Janecka asked.

Muras asked whether the county could apply the two-cent tax increase to only those who live outside the city limits.

“That wouldn’t be fair either, because the people who live in the rural areas go to the cities to buy stuff, and their sales tax goes toward that,” Janecka said.

“The people I’ve talked to said they’re totally against three to four cents,” Berckenhoff said. “Two cents, they said they could live with that.”

McBroom raised a concern that the proposed tax increase may diminish the fire departments’ fund raising efforts. He said citizens may feel less inclined to support fire department fund raisers if they have to pay an additional tax for fire services.

“One person called me and said that,” McBroom said in an interview on Wednesday. “You’re trading one thing for another.”

Janecka said that if the tax increase doesn’t pass, fire departments may try to form emergency service districts (ESD), which are independent taxing entities. Flatonia began the process of forming an ESD last year but has since put that plan on hold.

“Those things are ten cents,” Janecka said. “That’s a far cry from two cents. My concern is that you’ll have one in Flatonia, then one in Muldoon, one in Schulenburg, maybe eight or ten of them.”

If that tax increase is approved, Fayette County’s property tax rate would go from $0.4202 to $0.4402 per $100 valuation. That would amount to a $20 increase in the tax bill on a $100,000 home.

Current Tax Rates for Surrounding Counties

| County | Tax Rate (Per $100) |

| Lee County | $0.66 |

| Washington County | $0.5211 |

| Colorado County | $0.48206 |

| Austin County | $0.5443 |

| Lavaca County | $0.4338* |

| Gonzales County | $0.3449** |

*Lavaca County has proposed a $0.5301 tax rate for 2017.

**Gonzales County has two ESDs that funds EMS and fire services. Residents there pay additional property taxes to the ESDs.

Fayette County Record

127 S. Washington St.

P.O. Box 400

La Grange, TX 78945

Ph: (979) 968-3155

Fx: (979) 968-6767